Karachi: The first month of the current fiscal year witnessed a decline of 8.6% in remittance inflows compared to the amount sent by overseas Pakistanis in June, the State Bank of Pakistan said on Tuesday.

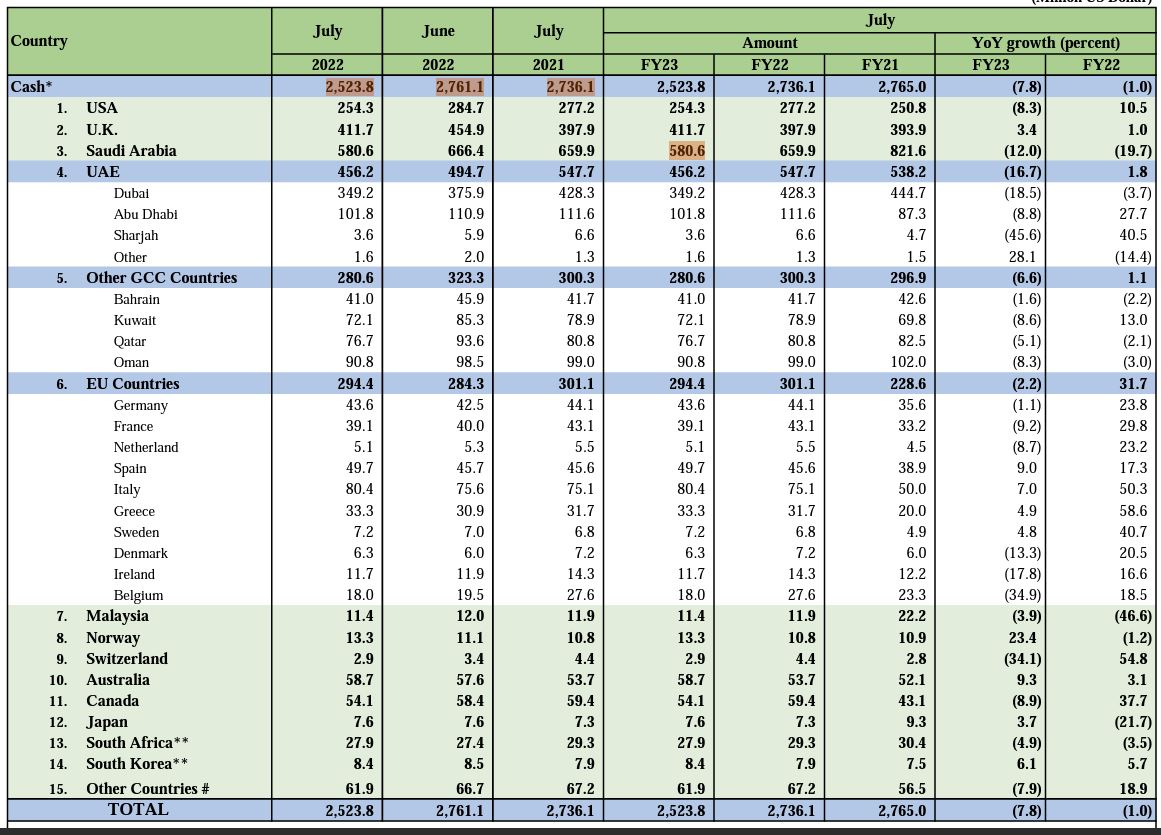

According to the report, the total remittance inflows amounted to $2.5 billion in the July of FY23 compared to $2.761 billion in June of FY23 – a significant 8.6% decline on a month-on-month basis.

Similarly, on a year-on-year basis, the total remittance inflows recorded a decline of nearly 8%, as the remittances amounted to $2.73 billion during July last year.

The State Bank said that this drop was mainly due to “considerably fewer working days because of [the] Eid holidays”.

However, the daily average rate of remittances was 18% higher in July than in June, the SBP added.

At $2.5bn remittances remained strong in Jul. While they fell by 8.6% compared to Jun, this was due to considerably fewer working days because of Eid holidays. The daily average rate of remittances was 18% higher in Jul than in Jun.https://t.co/pj3qT9tNav https://t.co/7XBd4uNES4 pic.twitter.com/GWOlJA4eSc

— SBP (@StateBank_Pak) August 16, 2022

Countrywise, Saudi Arabia topped the list of the biggest contributor via workers’ remittances with $580 million during July FY23, down from $666 million recorded a month earlier in June.

Similarly, inflows amounted to $456 million from the United Arab Emirates, down from $494 million in June.

From the United Kingdom, remittance inflows amounted to $411 million – a nearly $43 million decline from June’s $454 million.

Pakistan heavily depends on the influx of remittances to meet its foreign exchange needs because exports hardly cover the high level of imports.

The trade deficit soared to $48.38 billion during the last fiscal year. To help alleviate the pressure on reserves, remittances play a crucial role to bring down the current account deficit to $17 billion during the same period.

According to the Pakistan Bureau of Statistics report on July’s trade, there was a significant difference in exports and imports, taking the imbalance to $2.73 billion MoM in the first month of FY23.

Read: Pakistan’s reserves fall below $8 billion; lowest since Oct’19