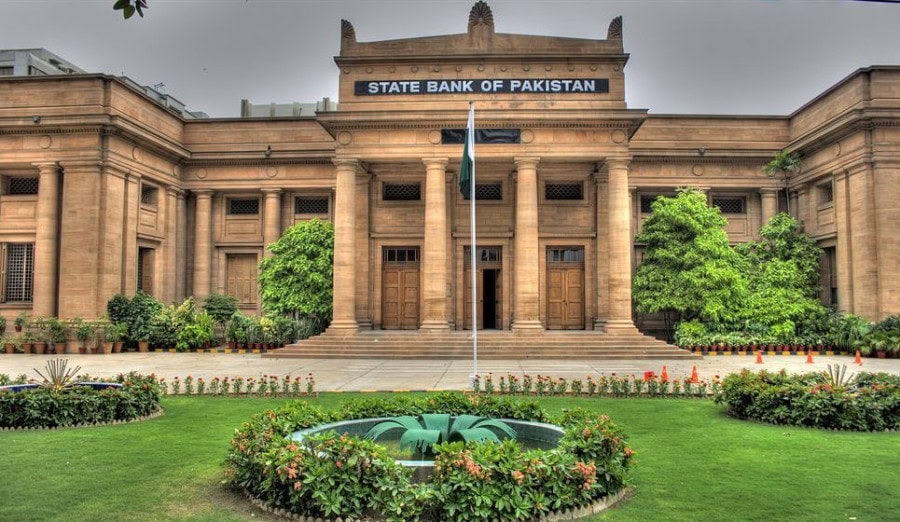

Karachi: The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) will meet on Thursday, July 7, to decide on the monetary policy for the next two months. This time, however, an increase of 100 to 125 basis points is expected, given the record inflation of 21pc in FY22.

In a statement, the SBP Tuesday said the Acting Governor of the SBP, Dr Murtaza Syed, will give a press conference on the same day after the MPC meeting.

Monetary Policy Committee of #SBP will meet on Thursday, July 07, 2022 to decide about Monetary

Policy. Acting Governor State Bank of Pakistan, Dr. Murtaza Syed will give a press conference on the

same day after MPC meeting.https://t.co/zQyYnyF41p— SBP (@StateBank_Pak) July 5, 2022

In its previous meeting, the MPC raised the benchmark interest rate by 150 bps in May, taking the total increase to 400 bps so far this year to counter rising inflation. The current policy rate of 13.75pc is the highest since June 2011.

This time as well, the SBP is expected to raise its key policy rate by 100-125 bps as it attempts to tackle 13-year high retail inflation.

Pakistan is wrestling with economic turmoil, a fall in reserves and a weakening currency.

Data on Friday showed consumer prices in June leapt 21.3% from a year earlier, largely on account of a 90% spike in fuel prices since the end of May after the government scrapped costly fuel subsidies.