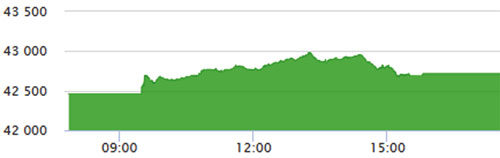

Gold price plunges by Rs4,600 per tola; PSX gains 258.83 points

The rupee snapped its losing streak against the US dollar, gaining Rs4.70 in the interbank market a day after it was reported that the government secured the much-anticipated deal with the International Monetary Fund.

The dollar closed Rs207.23, against Wednesday’s record high of Rs211.93. In open market, local currency also gained Rs4 against the greenback, which was being traded around Rs209.

The development comes after weeks of persistent declines in the rupee’s value, which has been largely attributed to the country’s rising import bill and depleting foreign exchange reserves. Mettis Global Director Saad Bin Naseer stated that the rupee’s correction was “long due”. “With news of foreign exchange inflows from China and an imminent deal with the International Monetary Fund, we believe the rupee will gain strength in the coming sessions,” he said. “As inflows rise, we expect exporters, who have been holding their earnings abroad, will panic and remit their earnings back in view of the appreciation in rupee’s value against the dollar,” he added. Komal Mansoor, head of research at Tresmark, said market sentiment had taken a U-turn on the “influx of positive news”. “Exporters have also started selling dollars in spot and forwards. A gradual strengthening of the rupee will encourage them to sell more, thereby improving liquidity position,” she said.

Analysts believe that some exporters are still waiting for actual flows to materialise before taking any action, she added.