Dollar rises to Rs204 in interbank trade

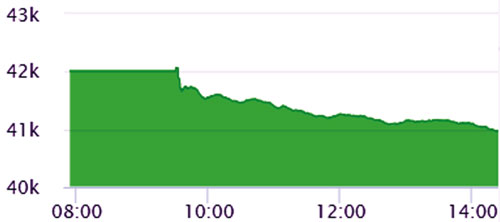

The Pakistan Stock Exchange witnessed intense selling pressure on Monday with the benchmark KSE-100 index opening in the red and plunging by 1,134.80 points to close well below the 41,000 mark in what experts said was a reaction to the annual budget presented by the federal government on Friday.

Analysts linked the bearish activity to the government increasing taxes on the banking sector in the budget, among other factors.

According to the Pakistan Stock Exchange website, the index was down 1,016.79 points at 3pm and continued to slide in the last hour of trading to close 1,134.80 points, or 2.7pc, down. Head of research at Intermarket Securities, Raza Jafri, said the stock market was under pressure due to the index heavyweight banking sector being sharply down.

“This is because the banking sector has been saddled with a significantly higher tax rate,” he said, adding that the new budget removes the tax credit available on investing in mutual funds and life insurance, which is also raising concerns over redemptions.

Meanwhile, the US dollar rose to a historic high of Rs204 against the local currency in the interbank market on Monday, with analysts attributing the rupee’s decline primarily to pending oil-related payments and declining foreign exchange reserves.