Luxembourg remains the European leader in the domiciliation of Islamic funds. But the sector has changed little since 2016 and is now facing competition from other financial hubs. The market is less buoyant than expected, due to the lack of local roots.

Still discreet and relatively marginal, Islamic finance has long been announced as “promising” in Luxembourg. It is true that its growth is continuing. But it still only represents 0.11% of the assets under management within the country’s funds sector. The success is therefore very relative.

According to Fitch Ratings figures for Q3 2021, Luxembourg has, however, led the European Islamic fund industry since 2016, with 30 Shariah-compliant funds composed mainly of mutual funds. Ireland has 16, consisting of both mutual funds and exchange-traded funds (ETFs), and the UK has around 5, mainly pension funds. At the end of Q3 2021, Luxembourg was also ahead of Jersey (13 active Islamic funds, mainly ETFs) and the Cayman Islands (10 mutual funds).

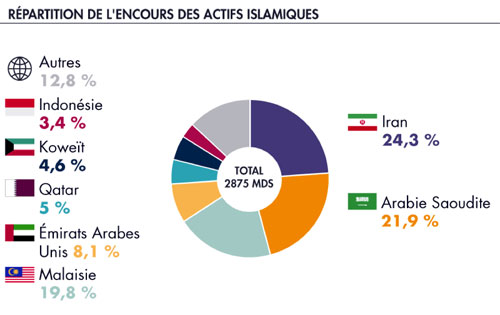

Luxembourg’s Islamic fund sector has grown by 122% over the past six years, with total assets under management of $6.7bn, placing the country among the top five in this segment globally, with Saudi Arabia and Malaysia remaining the two largest domiciles for Islamic funds in the world.

In a report on the expansion of Islamic funds, Fitch estimated that the growth rate of Islamic funds globally (84% nominal and 13% annualised) has outpaced that of the global mutual fund industry (68% nominal and 11% annualised), based on the latest comparable data for the five years to the end of Q3 2021, according to data from Lipper and ICI Global.

Global Islamic finance is doing well. But while it remains a key sector for the Luxembourg government as part of its strategy to diversify financial centres, it is not acting as a major economic lever.

Regulatory framework remains attractive

Emmanuelle Entringer is counsel in the investment management practice, specialised in Islamic funds, at the law firm of Arendt & Medernach, based in Dubai. She advises Muslim fund managers wishing to establish themselves in Luxembourg and informs them about the regulations in force.

She pointed the popularity of the Luxembourg financial centre among investors since 2008: “Historically, there has always been a recognition of investment products and Islamic finance in Luxembourg. At the level of funds, the sector has benefited from a tolerance: the Financial Sector Supervisory Commission (CSSF) considered that as long as the rules that applied to investment funds in general were compatible with those applied to Islamic finance, there was no reason to refuse funds that obeyed Sharia standards. It should be noted that not all funds of Islamic origin are Shariah compliant, depending on the degree of religiosity of the issuer or its region of origin.”

The CSSF has indeed not modified its instruction report on Islamic UCIs since May 2011, which was rather conciliatory towards investment products that meet Sharia criteria. The provisions of the laws of 17 December 2010 relating to UCIs and the law of 13 February 2007 relating to specialised investment funds therefore apply to the authorisation and supervision of “Sharia UCIs” in the same way as for other types of investment funds under Luxembourg law.

Land of milk and honey?

The context for welcoming more Islamic investors in Luxembourg seems favourable. The announced boom of Islamic finance since 2008 was a political decision by the former minister of finance Luc FriedenLuc Frieden (CSV), and continued by Pierre GramegnaPierre Gramegna (DP). However, it has not really happened.

This is partly due to the fact that Luxembourg is facing increasing competition from other financial hubs such as Ireland or Jersey, in a global context where Islamic finance remains very regionalised (investors from Muslim countries mostly turn to local firms) and underdeveloped in the world (less than 1% of global finance).

Moreover, Islamic finance at the European level appeals primarily to Muslim investors, who are few in number in Europe.

Finally, although Luxembourg remains in the top 5 of attractive countries for Sharia-compliant investments, no Islamic governance bank has yet been legally established here, which could have given a boost to the sector, despite what Bandar Hajjar, president of the Islamic Development Bank, had planned in 2019. “However, banks in the marketplace can serve as depositories for sharia-compliant funds,” said Entringer.

No issuers in the market

The Fitch report also considered that while Luxembourg can remain a leader in Islamic fund management, its future in the sukuk and Islamic banking markets appears to be in jeopardy for the foreseeable future due to the lack of issuers based in the country.

The report stated that: “the domestic Islamic finance system in Luxembourg remains underdeveloped compared to the UK, for example. There are no Islamic banks or sukuk in circulation issued by Luxembourg-based issuers or takaful [editor’s note: Sharia-compliant insurance securities], and the country does not have a national Sharia governance framework. This is mainly due to the lack of bottom-up public demand for Islamic products, as less than 3% of the population in Luxembourg is Muslim.”

— Written by Aurélie Boob