Zubair Yaqoob

Karachi

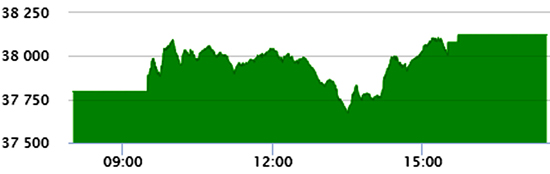

Political uncertainty took center stage since yesterday, when SC took notice of Army Chief’s extension. Considering this issue to be a procedural issue, which will be resolved by the Govt., market took a positive view of the situation and partly recovered points lost in yesterday’s trading. All in all, the index gained 311pts during the session, and closed the session at +328pts. Session did saw a loss of 123pts as the remarks by SC judges came in public, denting investor sentiment for a while. Buying activity was largely observed in Steel and Cement sectors, wherein Steel and Auto sector scrips hit upper circuits. Cement sector led the volumes with 49.7M shares, followed by Vanaspati (24M) and Food (23.5M) repeating yesterday’s performance. Among scrips, 2 of the top volume leaders were UNITY (24M) and FFL (19.9M) followed by MLCF (15.3M) which closed at upper circuit. The Index closed at 38,123pst as against 37,795pts showing an increase of +328pts (+0.9% DoD). Sectors contributing to the performance include Banks (+132pts), Power (+31pts), Tobacco (+31pts), Fertilizer (+22pts), and Autos (+14pts).

Volumes declined significantly by 53% to reach 228.1mn shares against 488.7mn shares. Average traded value also declined by 57% to reach US$ 51.5mn as against US$ 118.5mn. Stocks that contributed significantly to the volumes include UNITY, FFL, MLCF, MLCFR1 and PAEL, which formed 37% of total volumes.