How govt can mitigate the effects of prevailing inflation?

THE country is trembling with the record-high inflation and the government is justifying the situation citing international factors and argues its inability to do something to safeguard the poor and middle classes.

There is no disagreement to the point that current wave of inflation is mainly because of international factors, however, the point that government is unable to do anything to reduce the miseries of the public is highly questionable.

What can the government do in this situation? The government needs to know that a treasure of 2.7 trillion is being paid from the public money for controlling inflation.

The least that the government can do is to withdraw this inflation control fee and use it for the social security programs.

At present Pakistan owes a domestic debt of 26 trillion and has allocated 2.7 trillion to pay markup on this debt.

More than half of the tax revenue and petroleum development levy are used to pay this markup.

The government can choose a low interest rate to reduce this markup payment or can print money to repay this entire amount.

The only reason to pay this huge amount from public money is the fear of inflation; the government thinks that a low interest rate and/or money printing can spark a hyperinflation. Therefore, this amount is nothing but a fee to control inflation.

But unfortunately, the government thinks that not paying this fee would bring inflation but in fact the payment of this fee is a major cause of inflation. This inflation control fee is counterproductive and the taxes collected to pay this fee ignite inflation instead of reducing it.

In Pakistan, the interest rate on different debt instruments ranges between 7% – 11%, among the highest in the world. If we choose the interest rate prevailing in the United States, the markup payments would reduce to 100 billion instead of 2700.

If the interest rate of India, Indonesia or Thailand was chosen, markup payments would reduce to 1300 billion, 950 billion and 150 billion respectively, providing a huge fiscal space of 1500 billion or above.

What is the logic of choosing one of the highest interest rates in the world? The answer could be found in the monetary policy statements of the State Bank of Pakistan (SBP).

In the monetary policy statements, inflation is the most cited reason for justifying interest rate. The SBP thinks that high interest rate can reduce inflation and chooses a higher interest rate when expects a rise in inflation.

Now at present, the SBP and government have admitted that inflation is because of international factors they cannot control it, there is no logic of having such a huge inflation control fee.

Therefore, the first thing that the government can do is to withdraw this inflation control fee and to bring the interest rate at par with the peer economies like Vietnam and Indonesia.

If this happens, the government can automatically save an amount sufficient to finance all the social security programs and along with huge development projects and a handsome amount for salary increase altogether. That is the simplest solution to deal with the problems created by huge inflation.

In fact, the relationship between interest rate inflation is very misunderstood. The textbook theories tell us that high interest rate reduces inflation, but the ground realities are quite opposite. The historical data indicates that high interest rate leads to high inflation and vice versa. For example, interest rate in Brazil was 14% in 2017.

Brazil reduced the interest rate to 2% in a couple of years and the inflation also followed the same trend, coming down to 5% from 11%.

There are so many other examples from the entire world and from Pakistan, all showing an association between high interest rate and high inflation. This is quite to the popular Inflation Targeting Framework predicts a negative association between two variables.

In the post, covid-19 inflation episode, some countries have attempted to control inflation by increasing interest rate, and none of these countries was successful.

This is not big surprise because standard economic theory predicts that high interest rate at the time of supply side inflation would add to inflation and the current wave of inflation is also supply side.

That’s why most of the advanced economies haven’t opted to increase the interest rate in this time of high inflation.

The historical data indicates that a fall in interest rate is followed by falling inflation and vice versa.

Therefore, an optimal policy at this time is to reduce interest rate which will save enough amount to provide relief to the public. At present, 22 countries of the world have zero interest rate and none of these countries faced a hyperinflation.

A question that arises that would the banks be willing to lend to government if the interest rate is lower than inflation.

In fact most of the countries today have higher inflation than interest rate. For example, in the US, the interest rate today is 0.25%, whereas the inflation is above 5%. Similarly, in the UK, Germany Italy, Australia, New Zealand and many other countries have negative real interest rate.

So it won’t be a surprise if Pakistan is having a negative interest rate. The banks cannot refuse to lend because they don’t have any other option to invest the money currently invested in public debt.

The commercial banks have invested about 26,000 billion in government securities and it is not possible for them to find alternate opportunity to invest this money.

Suppose due to reduction in interest rate, the commercial banks withdraw 1000 billion rupees from the government securities and invest the same in private sector, this means a huge amount would be available for the businesses and consumer financing at a cheap interest rate. This will be really a good news and a big boost for the economy.

But how the government can manage the money required to run the affairs if the banks withdraw some of the money from government securities? Well, the sovereign governments are authorized to use their central banks to create money, but this option is not used due to fear of inflation.

It’s true that creating uncontrolled money can spark hyperinflation, but money created in a measured and controlled manner can help in running economy without any hyperinflation.

For example, the UK borrowed such a huge amount from its central bank that the debt to GDP ratio increased by 20% in 2020.

Despite such a huge borrowing, the inflation in the UK in 2020 was less than the previous year.

Many other European economies borrowed extensively from central banks without any inflationary effect during 2020. Actually, the reason for inability to control effects of inflation is the fear of inflation.

Once we overcome this fear, the economy could be managed in a much better way.

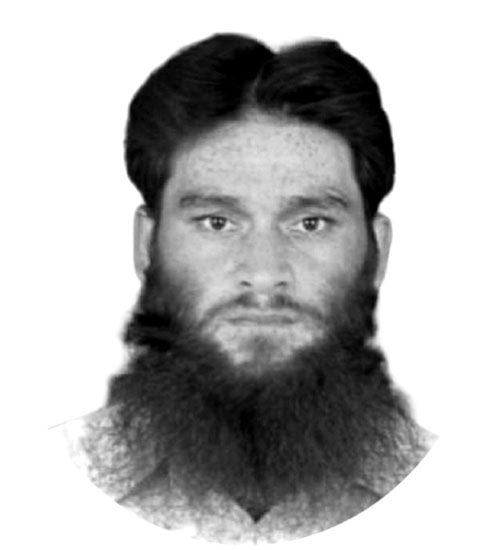

—The writer is Director, Kashmir Institute of Economics, Azad Jammu and Kashmir University.