Dubai

Worldwide spending in Islam-inspired ethical consumption sectors is set to increase 45 per cent by 2024, reaching $3.2 trillion from the end of last year, according to a new report.

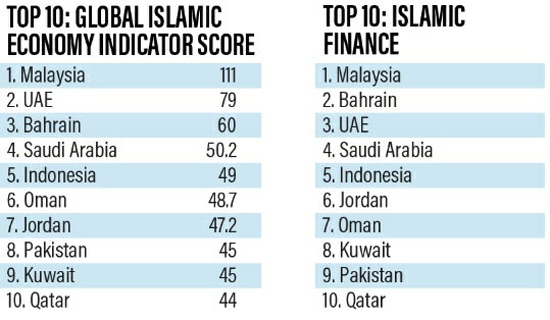

Malaysia, the UAE, Bahrain and Saudi Arabia continued to lead the Global Islamic Economy Indicator rankings out of 73 countries, according to the seventh annual State of the Global Islamic Economy survey done by DinarStandard, a research and advisory company in the US. Indonesia made the biggest jump from 10th to fifth place.

The indicator score is a composite of 49 metrics, such as supply and demand and governance, weighted across sectors relative to size.

It covers seven sectors, including Islamic finance and six consumer sectors: halal food, modest fashion, pharmaceuticals, cosmetics media and recreation , and Muslim-friendly travel. Islamic finance is the largest sector at $2.5tn, followed by halal food, which totalled $1.4tn last year.

While Malaysia topped in the Islamic finance and Muslim-friendly travel categories, the UAE led in the five other sectors, including halal food and modest fashion.

“The UAE’s consistent rank among the top three in the Global Islamic Economy Indicator year after year is a key outcome of the Dubai: Capital of Islamic Economy initiative and its positive impact on the nation’s economy,” said Sultan Al Mansouri, Minister of Economy and chairman of the Dubai Islamic Economy Development Centre. Sheikh Hamdan bin Mohammed, crown prince of Dubai, established the DIEDC in 2013 to develop and promote the emirate as the global capital of the Islamic economy. Spending in the six consumer sectors in Islamic economies grew 5.2 per cent in 2018 year-on-year and is expected to grow at a compound annual growth rate of 6.2 per cent over the next five years.

Islamic finance assets are expected to grow at a 5.5 per cent CAGR to hit $3.4tn during the same period. Investments in Islamic economy companies have recorded tremendous growth of around 400 per cent to $1.2bn in the 12 months to July 31, with 63 deals in 18 countries.

More than half was invested in halal products, 42 per cent in Islamic finance and 4 per cent in the other Islamic lifestyle categories. However, Islamic economy deals remain a small fraction of the $596bn invested globally in consumer and financial services sectors, highlighting the future growth opportunity.

The global Islamic economy has gained increasing importance due to growing demand for products and services that are Sharia-compliant. It also presents a growth opportunity for the 57 member states of the Organisation of Islamic Co-operation (OIC). The report estimates that OIC economies can experience a boost of 1 to 3 per cent in gross domestic product through trading of halal products.

The study included all OIC countries, as well as non-OIC countries with a strong presence in the halal industry, such as Brazil, Australia, the UK, Germany, France, the US, Canada, China and Russia. “The report has helped make a business case for funding start-ups and driving multiple national level halal economy strategies and investments as well as corporate expansion initiatives,” said Rafi-uddin Shikoh, chief executive and managing director of DinarStandard.

The core drivers of the Islamic economy among consumers, according to the report, include a growing Muslim population, rising affluence, increasing religious affinity, digital connectivity and ethical consumerism.

The global Muslim population is expected to grow to 2.2 billion by 2030 from 1.7 billion in 2014, according to the Pew Research Centre’s Forum on Religion and Public Life. For businesses, governments and investors, the drivers include multinational growth, economic diversification and development, a boost in inter-OIC trade and investor returns. Saudi Arabia and Turkey are the only OIC countries in the top 25 economies around the world. “OIC governments are seeking to boost GDP growth and diversify their economies, increase foreign direct investment and develop global consumer packaged goods champions, with Malaysia, the UAE and Indonesia setting the tone for developing national Islamic economy strategies,” the report said.

—(Courtesy: The National)