The Pakistan Stock Exchange (PSX) turned bullish on Thursday, with the benchmark KSE-100 Index gaining 532.86 points (+1.2 percent) to close at 44,899.6 points.

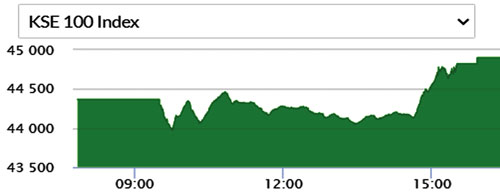

The market opened on a negative note and remained negative for a couple of hours. However, the mid-day trading helped the index recover some of the losses, while the last ninety minute session saw bulls coming back roaring. The KSE-100 Index witnessed trade of 87 million shares in the last half an hour.

The KSE-100 Index moved in a range of 927.6 points, showing an intraday high of 44,899.6 (the closing point of the session) points and a low of 43,972 points. Among other indices, the KSE All Share Index gained 406.09 points (+1.34 percent) to close at 30,668.89 points, while All Share Islamic Index gained 393.91 points (+1.84 percent) to close at 21,858.88 points.

A total of 381 companies traded shares in the stock exchange, out of them shares of 242 closed up, shares of 126 closed down while shares of 13 companies remained unchanged.

Out of 97 traded companies in the KSE-100 Index, 74 closed up, 22 closed down, and one remained unchanged.

The overall market volumes decreased by 96.33 million to 372.43 million shares. Total volume traded for the KSE-100 Index was 212.62 million shares. The number of total trades decreased by 48,733 to 120,298, while the value traded decreased by Rs2.64 billion to Rs13.76 billion. The market capitalisation increased by Rs103.33 billion.

Among scrips, KEL topped the volumes with 32.48 million shares, followed by BYCO (29.77 million) and ANL (20.83 million). Stocks that contributed significantly to the volumes include KEL, BYCO, ANL, WTL and DCR, which formed 32.6 percent of total volumes.

The sectors propping up the index were commercial banks with 139 points, cement with 136 points, oil & gas ex-ploration companies with 107 points, power generation & distribution with 35 points and oil & gas marketing companies with 29 points.

The most points added to the index were by MEBL which contributed 77 points followed by KEL with 46 points, PPL with 38 points, OGDC with 34 points and LUCK with 33 points.

Sector wise, the index was let down by fertilizer with 14 points, technology & communication with 7 points, tobacco with 7 points, pharmaceuticals with 5 points and real estate investment trust with 4 points.

The most points taken off the index were by FFC which stripped the index of 34 points followed by HBL with 27 points, SYS with 23 points, COLG with 20 points and HUBC with 10 points.

According to analysts, the investor’s sentiments shifted mainly due to diffusion of speculation around the proposed bill in the US Senate which seeks to sanction the Taliban and the countries accused of supporting them.

On the announcement front, Fauji Fertilizer Bin Qasim Limited (FFBL) informed the PSX through a notification about the successful completion of the sale and transfer of its entire shareholding in FWEL-I and FWEL-II to FFC. TLTP