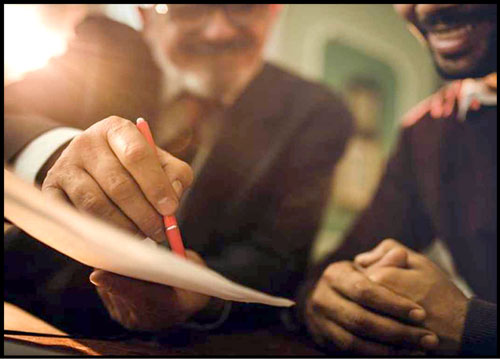

Ayman Sejiny, CEO of the Islamic Corporation for the Development of the Private Sector the private sector arm of IsDB Group, and Hassan Usman, managing director and CEO of Jaiz Bank-Nigeria, signed a $25 million Shariah-compliant line of financing agreement to support SMEs in Nigeria, including those adversely affected by the Covid-19 outbreak.

Out of this $25 million LoF, $10 million is being allocated under the ICD’s $250 million Covid-19 support package to help the private sector affected by the pandemic by leveraging on the expertise of the banking system of its member countries.

ICD’s LoF facility will help to expand Jaiz Bank’s customer base by provision of Shariah-compliant financing in response to the growing demand for Islamic finance to support, among others, projects and industries affected by Covid-19.

Sejiny said: “Continuous cooperation between ICD and Jaiz Bank, the pioneer in Islamic banking in Nigeria, will result in easier access by SMEs to Shariah-compliant financing that will meet their funding needs, as well as assist in keeping businesses open and preserving jobs, which is in line with ICD’s commitments to help the Nigerian economy to overcome the adverse impact of the COVID-19 pandemic and strengthen financial inclusion.

We have no doubt that this LoF facility will provide much needed support to private sector businesses including those which have been affected by the pandemic”

Usman added: “We are delighted with this partnership with ICD, which started in 2018 with a $20 million line of finance to support SMEs in Nigeria.

The line was fully utilized by eligible SMEs, with substantial portions going to the agricultural sector.

The facility was fully repaid earlier this year and has helped in generating over 791 direct jobs and positioned the bank among the major banks in repatriating non-oil export proceeds for the country.

The additional $25 million line of financing facility will further enhance the bank’s capacity to continue to provide support to the local private sector enterprises with substantial socioeconomic impact.

“We appreciate ICD for extending this facility in such a challenging time due to the COVID-19 pandemic when economies need banks to further support their customers, especially SMEs in order to foster economic growth and direct job creation.”

Jaiz Bank PLC, the premier Islamic bank in Nigeria commenced operations in 2012 to deliver innovative financial solutions and exceptional customer experience

The bank started with a regional license obtained from the Central Bank of Nigeria to operate in the northern part of the country, and thereafter, transformed into a national bank in 2016, with key presence in virtually all regions of the country.—Zawya News