Staff Reporter Karachi

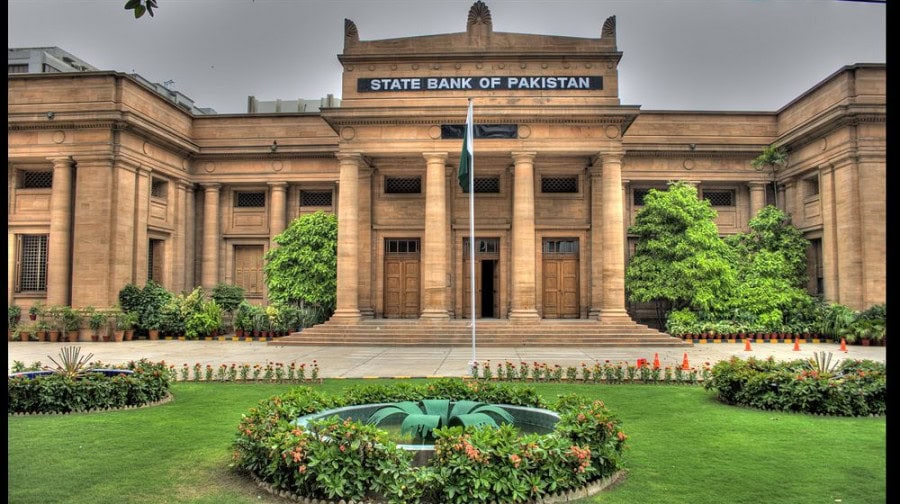

PayFast, the indigenous payments solution by APPS, is now the first payment gateway in the country to receive a commercial license from the State Bank of Pakistan (SBP) under its rules for Payment System Operators / Providers (PSO/PSP).

PayFast enables merchants, billers and aggregators to receive payments from their customers through a variety of methods such as bank accounts, wallets and domestic and international payment schemes.

The gateway operates with state of the art security, thereby mitigating risk for its customers through PCI-DSS certification and a data-driven fraud monitoring system.

PayFast addresses merchant pain points while accepting orders online, which has seen a striking escalation since the covid-19 pandemic.

The number of e-commerce merchants registered with banks has increased from 1,400 to almost 2,500 in a year, contributing to Pakistan’s exponential growth in e-commerce, which is all set to cross $3 billion by the end of 2021.