Analysis of proposed SBP Amendment Act

SOME policies of the international financial insti tutions depict a double standard.

The countries influencing the policies of these financial institutions have quite different set of policies for themselves and these institutions enforce a different set of policies for the countries under their influence. The monetary policy is a classic example of this double standard.

An important feature of the proposed SBP Amendment Act is that it makes price stability the central objective of SBP.

This idea of making price stability core objective is called inflation targeting which began in New Zealand in the early 1990s and has been adopted by many other countries.

At present, the written manifesto of most of the central banks is based on Inflation Targeting, but practically, most of the countries have abandoned using it.

The idea of the Inflation Targeting Framework is that the central bank’s primary objective is to ensure price stability and the main tool for this purpose is interest rate.

According to the mainstream economic theories which provide justification for inflation targeting, if interest rates are raised, people will reduce their expenses leading to a fall in aggregate demand and ultimately inflation will reduce.

The inflation targeting countries announce a target rate of inflation and if actual level of inflation is higher than the target, central banks will raise interest to reduce it.

On the contrary, interest rates would be lowered if actual inflation is less than the target.

There are many caveats to the theory of inflation targeting, most importantly, the assumption on which this framework is based is incorrect.

The framework is based on the assumption that raising interest rates will reduce inflation and vice versa, but global experience shows that this assumption is not supported by historical data.

For example, in the United States, the average interest rate before 2007 was about 6% and average inflation was about 3.5%.

During the global Financial Crisis of 2007-08, interest rate was reduced to 0.5% and rates remained below 2% until 2017.

According to the theory of inflation targeting, this action should result in higher inflation, but the inflation after this cut has been less than 2%.

Similarly, data from any other European countries also show that inflation reduced after a reduction in interest rates. Brazil cut interest rates from 14% to 2% during the years 2017-19.

Theoretically, such a large reduction should lead to a storm of inflation, but inflation in Brazil steadily declined during these years.

History of monetary policy in Pakistan also indicates an opposition to theory of inflation targeting.

Under the PPP government, the benchmark interest rate known as policy rate has been above 12%, and inflation also remains over 10%.

During the PML-N government, the policy rate was reduced to 5.75% and the inflation decreased and remained low throughout the PML-N regime.

In 2018, when the PTI government took charge, the interest rate was raised again, this measure should have reduced inflation, but the opposite happened, proving the invalidity of the assumption of inflation targeting.

Therefore, central banks of many countries with constitutional mandate of inflation targeting are actually using Quantitative Easing and have practically abandoned inflation targeting.

For example, in 2019, England had a policy rate of 0.7% and inflation rate of about 1.8%.

In early 2020, the Bank of England reduced policy rate to 0.1%. The inflation also declined after this move and it is 0.4% today.

On one hand, this reduction implies the failure of the basic assumption inflation targeting. The official inflation target for England is 2% and they have 0.4% today.

Therefore, Bank of England should have tried to return to the target as the inflation falls below the target, but they have forgotten it and are trying to maintain employment level against the spirit of inflation targeting.

The situation is similar in the United States, European Union and other advanced countries. New Zealand, the pioneer of inflation targeting also follows quantitative easing.

The second dilemma of the international financial institutions is reflected in the policy of borrowing from central bank. Borrowing from central bank simply means printing and using the currency.

International financial institutions continue warning third world countries not to borrow from the central bank to avoid catastrophic inflation.

But money creation is common practice in the countries influencing the policies of these institutions.

The UK budget has been in a deficit since 2012, and in 2020 the UK government pledged to pay 80% of the income of self-employed and the workers furloughed due to pandemic.

A question arises, from where did the government, which has been in deficit for a decade; get so many extra resources to finance the relief package? UK used Bank of England, and facilitated the people by seignior age, yet there was no storm of inflation resulting from this move.

Pakistan’s financial history also shows that borrowing central bank loans did not play a significant role in inflation.

During the PML-N era, the share of SBP’s lending in the public debt was 32% which has come down to zero today.

If the central bank’s lending was so deeply linked to inflation, inflation should have been higher during the PML-N era, but the opposite is true implying that borrowing from central is not necessarily inflationary.

For many countries, borrowing from central bank has been the most effective tool to counter the effect of pandemic.

These countries provided Covid relief packages ranging from 50 to 120 per cent of their normal budgets.

In times of crisis, the government revenue is bound to fall, so how can they finance such huge packages? All these governments used their central banks to facilitate the people.

The International Monetary Fund observes this and knows that central bank borrowing in these countries didn’t spark inflation, yet forcing countries like Pakistan to ban the central bank borrowing.

The two main features in the proposed SBP Amendment Act ie making inflation targeting core objective of central bank and ban of borrowing from central bank stand on false grounds and not supported by empirical data.

Borrowing from central bank is the weapon against recession and the SBP Amendment Act is going to deprive Pakistan from use of this weapon.

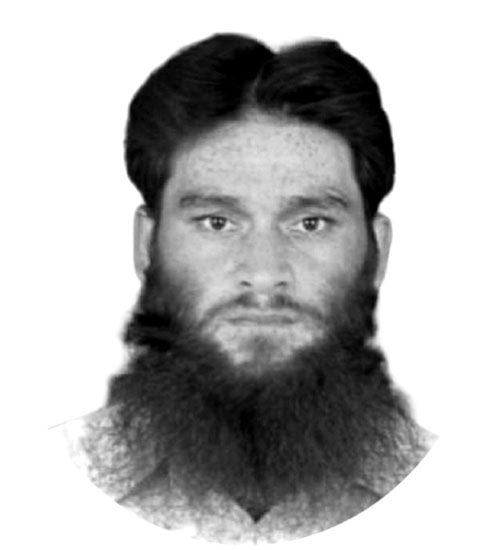

—The writer is Director, Kashmir Institute of Economics, Azad Jammu and Kashmir University.