Staff Reporter

Karachi

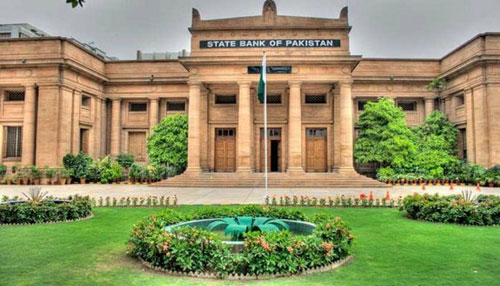

The State Bank of Pakistan (SBP) has been voted as the best central bank in promoting Islamic finance for the fourth time by a poll conducted by Islamic Finance News (IFN), REDmoney Group Malaysia, a statement said.

This is the second international award bestowed upon SBP for Islamic Banking during FY2021. Earlier, the Global Islamic Finance Awards (GIFA) also declared SBP as the best central bank of the year in September 2020.

IFN, while announcing the poll results stated, “It is always a closely contested battle for the top spot, but 2020 was rather more of a runaway victory than we have seen in recent years. The 2018 winner, the State Bank of Pakistan, achieved a decisive win with almost three quarters of the votes.” It was further stated by IFN that this year despite global pandemic, they have received the highest number of votes for the poll in their 16 years history.

The Islamic banking sector in Pakistan continued strong growth momentum during 2020 and its share in the overall banking industry’s assets and deposits stood at 16.0 percent and 17.3 percent respectively with a network of 3,303 branches in 122 districts across the country as of September 2020. Increasing financial inclusion by providing an enabling environment and promoting Islamic banking in the country is an important component of SBP’s strategy. Further, Islamic banking has been made an integral part of National Financial Inclusion Strategy (NFIS) of the government of Pakistan to serve those who prefer Islamic products or who are voluntarily excluded or underserved due to their religious belief.

Under the enhanced NFIS 2023, market share of Islamic banking in the overall banking industry has been targeted at 25 percent. SBP has always shown its resolve and commitment towards building sound foundations for sustainable growth of the Islamic banking industry in the country.