Kuala Lumpur

Bank Islam Malaysia Bhd aims to disburse RM20 million of loans to small and medium enterprises (SMEs) within five years through its new BangKIT Microfinance programme.

Bank Islam chief executive officer Mohd Muazzam Mohamed said the facility was expected to benefit 3,000 microentrepreneurs in five year.

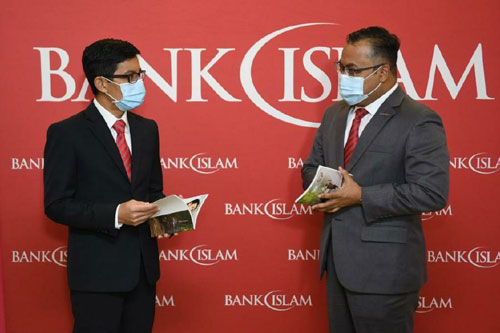

“As a start, RM2 million is allocated for BangKIT Microfinance. From this allocation, Bank Islam targets more than 200 microentrepreneurs to benefit from this facility, subject to the availability of funds,” Mohd Muazzam said at the lauch of BangKIT Microfinance.

According to Mohd Muazzam, BangKIT Microfinance was designed to assist selected unbanked and underbanked micro- entrepreneurs to obtain capital start-up business or business expansion and subsequently build a credit record to qualify them for other financings in the future. The bank believes that Islamic financial instruments could support Malaysia’s growth towards a high-income country.

“We put the Social Finance initiative as part of our 2021 Strategic Goals, and are strategising its wider implementation before the pandemic.

“As the world grappled with the economic outcome of Covid-19, the pandemic has accelerated our social, financial mission due to the urgent need for exploring all possible options to mitigate its impact on people’s livelihood and nation’s economy as a whole,” he said.

Meanwhile, Minister in the Prime Minister’s Department (Economy) Datuk Seri Mustapa Mohamed said banking and financial institutions had a collective role to play in rebuilding the country after the devastation by Covid-19.

Speaking at the launch, Mustapa said Islamic banking has great potential to capitalise on Islamic social financial instruments such as zakat, waqf and alms. “These instruments should not be limited to providing for the basic need and livelihood of the needy or for religious purposes such as construction of mosques and madrasa.

“The introduction of the social finance programme under the Prihatin Economic Stimulus Package, iTEKAD Micro Financing, is an example of a programme specifically to help and support B40 micro-entrepreneurs and the disadvantaged whose livelihoods have been impacted by the pandemic,” he said.

Offered under the al-Qard contract (interest-free), BangKIT Microfinance provides financing as low as RM500 to RM3,000 for start-up businesses and RM3,000 up to RM20,000 for business expansion with a repayment period of between six months to three years.

Customers will be provided with structured entrepreneurship training to ensure their business sustainability. Sadaqa House funds this microfinance facility from donations made by corporate institutions and the public.

Sadaqa House has also organised #KitaBantuKita campaign until January 31 next year to raise funds to help those affected by the third wave of Covid-19.As an added value, the campaign uses 1:1 matching basis. For every RM10 contribution made to #KitaBantuKita Campaign, Sadaqa House will match RM10 up to a maximum of RM500,000.—Agencies