Staff Reporter

Karachi

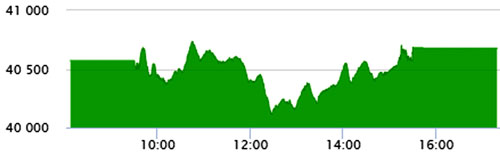

In a turbulent session at the bourse, the KSE-100 index on Thursday recouped losses to close as positive, aided by cherry-picking from investors, who bought stocks at attractive valuations.

Despite the positive close, stocks from index-heavy sectors faced substantial sell-off and a majority of them ended the day with losses.

After a brief open in the positive zone, the KSE-100 index succumbed to volatility and oscillated between positive and negative territories till midday. Buoyed by cherry-picking, a rally emerged at midday, which helped the index erase losses and close with gains.

At close, the benchmark KSE-100 index recorded an increase of 105.44 points, or 0.26%, to settle at 40,676.92 points.

The market lost roughly 2,000 points from its recent highs and in the process caused attrition in cement, steel and banking sector stocks, it said.

Financial and exploration and production stocks were major gainers of the day where UBL (+2.2%), HBL (+1.4%), MCB (+1.8%), Oil and Gas Development Company (+0.6%) and Pakistan Oilfields (+0.1%) closed in the green.

HBL moved up as the US Federal Reserve board announced the termination of enforcement actions with Habib Bank Limited Pakistan and Habib Bank Limited New York branch.

Moreover, crude oil prices in the international market were higher on the back of stimulus hopes.

Traded value stood slight lower at $76 million, down 19% and volumes came in at 372 million shares, down 22%.