Zubair Yaqoob

Karachi

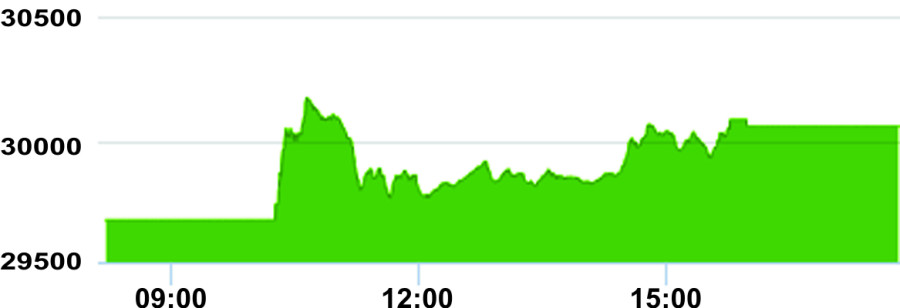

After encountering a technical glitch at start, the Index progressed well during the day, led by across the board buying activity in E&P, Banks, Cement and Steel Sectors.

The main reason behind the surge in index can be attributed to resolution a host of measures approved by SECP over the weekend that helped investors take a positive view on equities. Besides, the expectation of lower inflation reading going forward that hints of reduction in SBP policy rate.

Overall, the index went high by 506pts during the session and although receded later but rebounded at Market on Close (MOC). The Index closed at 30,057pts as against 29,672pts showing an increase of 385pts (+1.3% DoD). Sectors contributing to the performance include Commercial Banks (+130pts), E&P (+71pts), OGMC (+37pts) and Fertilizer (+35pts). Volumes decreased from 110.0mn shares to 77.4mn shares (-29.6% DoD). The average traded value decreased by 34.7% to reach US$ 16.5mn as against US$ 25.3mn. Stocks that contributed significantly to the volumes include WTL, MLCF, OGDC, KEL, and TRG, which formed 39% of total volumes. Stocks that contributed positively include PPL (+46pts), BAHL (+32pts), FFC (+27pts), UBL (+26pts) and HBL (+23pts). Stocks that contributed negatively include THALL (-8pts), MUREB (-7pts), MTL (-3pts), HASCOL (-3pts) and MARI (-2pts).