Zubair Yaqoob

Karachi

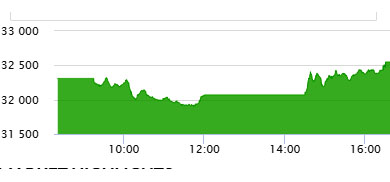

Index oscillated ~650 during the session with +240pts and -408pts. First session ended 240pts down and 49M shares traded, whereas second session saw recovery in the index resulting in +240pts (unadjusted). News of State Enterprise / Market opportunity Fund by State Enterprises helped improve investor sentiment in the second session. Buying activity took place in index heavy weights such as OGDC, PPL, PSO, LUCK, where PSO ended at upper circuit. Cement Sector led the volumes chart with 27M shares, contributed by MLCF (14.4M) and DGKC (4.5M), and followed by Technology (14M) and Power (12M). TRG ranked second in terms of traded volume with 12M shares. The Index closed at 32,459pts as against 32,310pts, showing an increase of 149pts (+0.5% DoD). Sectors contributing to the performance include E&P (+66pts), Fertilizer (+48pts), O&GMCs (+43pts), Cement (+26pts), Chemical (+9pts). Volumes increase by further from 87mn shares to 121mn shares (+39% DoD). Average traded value however, increased by 15.9% DoD to reach US 27.2mn as against US$ 23.5mn. Stocks that contributed significantly to the volumes include MLCF, TRG, KE, PAEL, and BOP, which formed 43% of total volumes. Stocks that contributed positively include ENGRO (+39pts), OGDC (+33pts), PPL (+31pts), LUCK (+24pts) and FFC (+23pts). Stocks that contributed negatively include UBL (-32pts), HUBC (-21pts), NESTLE (-17pts), DAWH (-10pts) and BAHL (-8pts).