Staff Reporter

Karachi

The Pakistan Stock Exchange bounced back on Monday to encouraging news of the current account, which helped remove the persistent sell pressure at the bourse.

According to the State Bank of Pakistan, the current account recorded a surplus once again with a positive balance of $424 million in July 2020. The revelation acted as the much-needed positive trigger and helped lift the market upwards.

Exploration and production stocks remained under selling pressure because of news of planned privatisation of Oil and Gas Development Company (OGDC) and Pakistan Petroleum Limited (PPL). A dip in global crude prices also enticed investors to offload oil stocks.

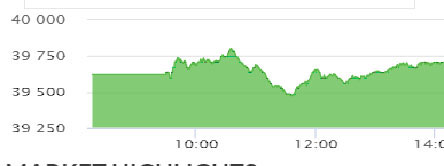

Earlier, trading got off to a positive start, however, the index succumbed to selling pressure within initial hours and was in the negative zone by noon. At that point, investors took cue from the surprising current account balance and strong sentiment supported the KSE-100 index in posting gains.

At close, the benchmark KSE-100 index recorded an increase of 181.01 points, or 0.46%, to settle at 39,802.6 points.

The index also registered a drop of 148 points from the previous trading session but rebounded by the end of the day and closed up by 181 points.

Cement, pharmaceutical, steel and oil and gas marketing sectors helped the index post gains. Among these, cement and pharmaceutical stocks reacted to expectations of an increase in product prices.