Observer Report

Islamabad

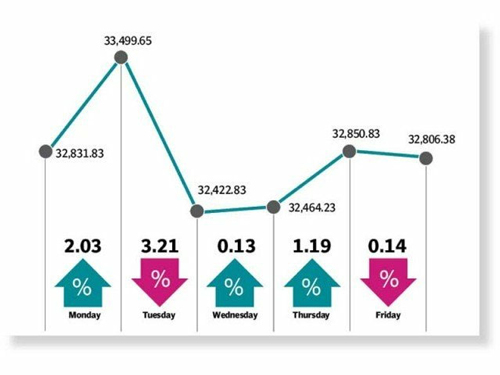

The Pakistan stock market struggled to rebound as the Covid-19 pandemic continued to hammer the global economy. The last week witnessed a mixed trend as the KSE-100 fell by a meagre 25 points to finish at 32,806 points.

Although wild fluctuations in global crude prices kept the bourse under pressure, the relative stability in the exchange rate and debt relief from the International Monetary Fund (IMF) lent some support to the index. Moreover, Pakistan received an emergency loan of $1.39 billion from the IMF to cope with the coronavirus pandemic, which pushed the country’s foreign currency reserves to a one-month high above $12 billion.

Trading kicked-off last Monday on an upbeat note as euphoria from the preceding session spilled into the new week. The index notched up smart gains on continued buying interest as investors continued to cheer the central bank’s surprise rate cut of 200 basis points.

In an unprecedented occurrence, the US benchmark West Texas Intermediate (WTI) crashed to close in New York at minus $37.63 per barrel on Monday amid a perfect storm of low demand, an output glut and a lack of storage. The development spurred selling pressure in the following session as investors offloaded index-heavy oil shares, which triggered a plunge of 1,077 points in the KSE-100 index.

Investors pared earlier gains as banks felt the heat of compression in net interest margins while oil scrips tanked with international oil prices. Comments from IMF Resident Representative Teresa Daban Sanchez that Islamabad had not requested the G20 countries for debt relief and expectations of a higher-than-expected inflation for April also added to the sour mood.

Despite a brief respite last Wednesday, the KSE-100 index endured mixed trading and finished with marginal gain in the green as tumbling oil prices weighed on index-heavy oil sector. Initially leveraged stocks gained traction (cements and steel; amid rate cut and news of potential price hikes) but market participants resorted to profit-taking by week-end as results disappointed.

Sentiment in the banking sector were further eroded with the State Bank of Pakistan barring banks from declaring dividends in the March and June quarter of the ongoing year so as to conserve capital.

“Albeit, large banks posted gains the following day on clarity regarding disbursement provision in case of board approved dividends for the outgoing quarter,” stated an AHL Research report.

Stocks managed to maintain the momentum and marched up on last Thursday as a host of company results announced during the day influenced market direction. News of potential external inflows from the World Bank and Islamic Development Bank, along with net inflows from foreign investments in the local debt market also kept investors hopeful.

Unfortunately, the index retreated to the red zone for the last trading day of the week. Market participants remained cautious over economic uncertainty caused by Moody’s report which projected that Pakistan’s fiscal deficit would reach 9.5-10% in fiscal year 2020 and growth would contract 0.1-0.5%.

Announcement of quarterly corporate results in cement, automobile and fertiliser sectors prevented investors from accumulating stocks with selling pressure weighing on sentiment. Participation picked up as average volumes jumped 46% to settle at 261 million shares, while average value traded increased 88% to clock-in at $71 million.

Sector-wise, negative contributions came from oil and gas exploration companies (down 49 points), power generation and distribution (44 points), and commercial banks (44 points). On the other hand, positive contributions were led by cement (128 points), fertiliser (64 points), and automobile assemblers (34 points).

Foreign offloading during the week arrived at $2.5 million compared to a net sell of $14.2 million last week. Selling was witnessed in fertiliser ($4.8 million) and banks ($4.1 million). On the domestic front, major selling was reported by individuals ($11.7 million) and broker proprietary ($4.7 million).